The real estate market is a place where most people will make their largest investment ever. It is a place where fortunes can be, and often are, made. It is not a place, however, for you to “wing it”.

The real estate market is a place where most people will make their largest investment ever. It is a place where fortunes can be, and often are, made. It is not a place, however, for you to “wing it”.

While the myriad TV shows about real estate make the process look so simple – it’s not really that simple… they make it seem like all you need to do is slap a for sale by owner sign in the yard, have one open house with fresh flowers and fresh baked cookies and bam! SOLD! in one day. Well I can tell you that in New Hanover County, North Carolina it takes an average of 121 days to sell a home. An average means that some houses take much longer to sell and some much less than 121 days to sell.

You need a professional, full time, well educated, ethical and trustworthy REALTOR to represent you whether buying or selling real estate.

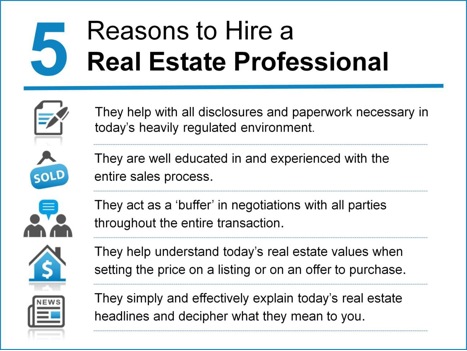

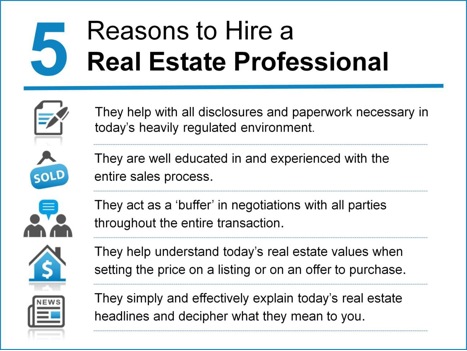

1 – Paperwork

Currently in North Carolina there are over 24 pages of contracts involved with buying or selling most homes. The state law requires much of this paperwork regardless or whether or not you hire a REALTOR. REALTORS are trained and educated on the contracts, which are constantly changing, so they can advise you during the process. They can also refer you to a real estate attorney to represent you on all legal matters involved in the process.

2 – Process

There are about 180 typical actions, research steps, procedures, processes and review stages in a successful residential real estate transaction that are normally provided by full service real estate brokerages in return for their sales commission. (Based on a report prepared by the Orlando Regional REALTORS Association). So this means that if you choose to go it on your own, you are going to have to do all 180 things yourself… or they don’t get done… which probably means your transaction doesn’t end in a successful purchase/sale.

3 – Negotiation

While there will always be that one guy (or gal) who thinks he (she) is the all-time greatest negotiator, the vast majority of folks do not like confrontational interactions. A negotiation for the purchase/sale of an asset as large as a piece of real estate can be a very confrontational interaction. The role of the REALTOR is to act as a buffer between the two parties who are in the midst of a very emotional and high-level financial transaction, both wanting to get the best they can get often at the detriment of the other party. A real estate professional is experienced in all aspects of the negotiation and is bound legally to do only what is in the best interest of his/her client.

4 – Values

Perhaps the single most important aspect of the transaction is the value of the piece of property.

If you are a seller you want to know how much you can expect to get for the sales price and how much of that you will walk away with in your pocket. You want to advertise the property for sale at the right price so you sell for as much as possible but you don’t want to price it so high that no buyers make you an offer (and YES if you price it too high MOST buyers will not want to offend you by making a low offer…thus you don’t get any offers).

If you are the buyer, you want to know how much to offer. Now multiple offer situations are happening more frequently and if a buyer offers too low, they can either be rejected completely by the seller or they can cause the negotiation to take too long thus allowing time for a competing bid to come in… allowing the seller to be in the driver’s seat.

5 – Teacher

Any good professional, whether a real estate professional, doctor, lawyer, CPA, etc., will have the heart of a teacher. Real estate brokerage is a service business. The professional REALTOR is there to educate you about the conditions impacting today’s real estate market. It is as easy as picking up the newspaper or searching the Internet for real estate news to see conflicting headline after conflicting headline. “Prices are up 20%”, “Among worst markets in nation”, “Best year since the crash”…well which is it? All real estate is local and your real estate professional will know the local market conditions and will lead you through the process, like any good teacher would, making sure you understand all that is going on around you.

A real estate professional is a crucial member of your team when buying or selling real estate. You could be buying your first home or your tenth home, an investment property or a vacation home, commercial or residential…whichever it is you are best served in the care of a full time, well educated, ethical, trustworthy real estate professional.

Contact Steve Hill and Sandra Brenner today for all your real estate needs.

Steve Hill and Sandra Brenner

Best In Client Satisfaction

Windermere Real Estate

BrennerHill.com

call/text 206-769-9577

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

We are here to save you pain, buyers. There are myths about the home shopping experience that must be addressed. We'd like to make the home buying experience as stress-free as possible, so please hear us out on these three big myths about home buying:

We are here to save you pain, buyers. There are myths about the home shopping experience that must be addressed. We'd like to make the home buying experience as stress-free as possible, so please hear us out on these three big myths about home buying: Many people ask us whether they should hire an agent to sell their home or whether they should first try as a For Sale by Owner (FSBO). In today’s market, we believe this is an easy decision: you need an experienced professional!

Many people ask us whether they should hire an agent to sell their home or whether they should first try as a For Sale by Owner (FSBO). In today’s market, we believe this is an easy decision: you need an experienced professional! There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

Designers share the color decorating mistakes that make them cringe.

Designers share the color decorating mistakes that make them cringe. The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).

The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).

The real estate market is a place where most people will make their largest investment ever. It is a place where fortunes can be, and often are, made. It is not a place, however, for you to “wing it”.

The real estate market is a place where most people will make their largest investment ever. It is a place where fortunes can be, and often are, made. It is not a place, however, for you to “wing it”.