PCS America, The Military Relocation Network

Free Business Listing or 20% off on Preferred Membership for businesses supporting our Military Forces (Active, Retired, Guard & Reserves)Visit www.pcsamerica.net or call 910-527-9300 for more information or to take advantage of this special offer.

Chili’s – free meal, Friday, Nov. 11 (2013). Chili’s is offering all military veterans past and present their choice of one of 6 meals. This offer is available from 11am – 5pm on November 11, 2013 at participating Chili’s in the U.S. only. Dine-in from limited menu only; beverages and gratuity not included. Veterans and active duty military simply show proof of military service. Visit their website to find locations.

Chili’s – free meal, Friday, Nov. 11 (2013). Chili’s is offering all military veterans past and present their choice of one of 6 meals. This offer is available from 11am – 5pm on November 11, 2013 at participating Chili’s in the U.S. only. Dine-in from limited menu only; beverages and gratuity not included. Veterans and active duty military simply show proof of military service. Visit their website to find locations.

Denny’s Veterans Day Appreciation Event, Nov. 11. 2013 (2013). Free Grand Slam breakfast to any veteran from. Participating markets include select diners in Maryland, Virginia, Arizona, New Mexico, Texas, Indiana, Colorado and Washington, DC (from 6:00am – 2:00pm), as well as the following New York locations: Syracuse, Rochester, and Buffalo areas (from 6:00am – 10:00pm). Call ahead to verify, and check with your local Denny’s if you live in another area. Source.

Denny’s Veterans Day Appreciation Event, Nov. 11. 2013 (2013). Free Grand Slam breakfast to any veteran from. Participating markets include select diners in Maryland, Virginia, Arizona, New Mexico, Texas, Indiana, Colorado and Washington, DC (from 6:00am – 2:00pm), as well as the following New York locations: Syracuse, Rochester, and Buffalo areas (from 6:00am – 10:00pm). Call ahead to verify, and check with your local Denny’s if you live in another area. Source.

Fox & Hound and Bailey’s Sports Bar (2013).Veterans and Active Duty Military will receive a free item from the 7 under $7 menu. Active military ID, retiree card, or other proof of service required. Visit site for location information.

Fox & Hound and Bailey’s Sports Bar (2013).Veterans and Active Duty Military will receive a free item from the 7 under $7 menu. Active military ID, retiree card, or other proof of service required. Visit site for location information.

· ies are franchises and may have different policies. We will do our best to keep this page updated as we find new info.

· Golden Corral – Free meal, Monday Nov. 11: The 13th annual Golden Corral Military Appreciation Monday dinner will be held on Monday, November 11, 2013 from 4 pm to 9 pm in all Golden Corral Restaurants nationwide. The free “thank you” dinner is available to any person who has ever served in the United States Military. If you are a veteran, retired, currently serving, in the National Guard or Reserves, you are invited to participate in Golden Corral’s Military Appreciation Monday dinner. For more information visithttp://www.goldencorral.com/military/.

· Special thanks to Golden Corral: To date, Golden Corral restaurants have provided over 3.2 million free meals and contributed over $6.1 million to the Disabled American Veterans organization. Amazing!

·  Famous Dave’s – Nov. 11th (2013). Free or discounted meals on Veterans Day. Offer varies by location, please check the Famous Dave’s Veteran’s Day page or call your local restaurant for more information.

Famous Dave’s – Nov. 11th (2013). Free or discounted meals on Veterans Day. Offer varies by location, please check the Famous Dave’s Veteran’s Day page or call your local restaurant for more information.

· See more Military Discounts.

·  Hooters – Free Meal, Nov. 11 (2013). Hooter’s is serving up a free meal to military veterans all day on Veterans Day. Offer good for all veterans and active duty military personnel. Get 10 Free Wings – Boneless or Regular, drink purchase required. Offer valid at participating Hooters only; open to all active duty and military veterans with valid military ID or proof of military service. For more information, visit, www.HootersVeteransDay.com.

Hooters – Free Meal, Nov. 11 (2013). Hooter’s is serving up a free meal to military veterans all day on Veterans Day. Offer good for all veterans and active duty military personnel. Get 10 Free Wings – Boneless or Regular, drink purchase required. Offer valid at participating Hooters only; open to all active duty and military veterans with valid military ID or proof of military service. For more information, visit, www.HootersVeteransDay.com.

·  Krispy Kreme – Free doughnut (2013). Available only at participating Krispy Kreme stores. Offer available to all active-duty, retirees & veterans on November 11th. Be sure to call ahead to verify your local Krispy Kreme is participating.

Krispy Kreme – Free doughnut (2013). Available only at participating Krispy Kreme stores. Offer available to all active-duty, retirees & veterans on November 11th. Be sure to call ahead to verify your local Krispy Kreme is participating.

·  Bar Louie, Free meal on Veterans Day (2013). Active duty military members and veterans can receive a free meal, up to $10 in value, and a free non-alcoholic beverage. Available at all locations, military ID or proof of service is required. See FaceBook page for more info.

Bar Louie, Free meal on Veterans Day (2013). Active duty military members and veterans can receive a free meal, up to $10 in value, and a free non-alcoholic beverage. Available at all locations, military ID or proof of service is required. See FaceBook page for more info.

· BJs Restaurant and Brewhouse, Nov. 11th (2013). Complimentary lunch entree or a one topping mini pizza for dinner. Offer valid to all active duty military and veterans, with proof of service. More info.

·  Champps Americana (2013). We’re celebrating our Veterans with an All American Meal! All Veterans and Active Military will receive a free burger on November 11th! Proof of service required. Offer not valid for the Pepperjack Bacon Stack Burger or Kobe Burger. Dine in only, valid at participating locations. Find a location near you.

Champps Americana (2013). We’re celebrating our Veterans with an All American Meal! All Veterans and Active Military will receive a free burger on November 11th! Proof of service required. Offer not valid for the Pepperjack Bacon Stack Burger or Kobe Burger. Dine in only, valid at participating locations. Find a location near you.

·  Little Caesars® Pizza (2013). Little Caesars is honoring the men and women of the United States armed forces this Veterans Day by providing veterans and active military members with a free Crazy Bread® with proof of military status or proof of service at participating stores nationwide. Find a location near you.

Little Caesars® Pizza (2013). Little Caesars is honoring the men and women of the United States armed forces this Veterans Day by providing veterans and active military members with a free Crazy Bread® with proof of military status or proof of service at participating stores nationwide. Find a location near you.

·  McCormick & Schmick’s Seafood Restaurants – free lunch or dinner, Nov 11, 2013 (2013):McCormick & Schmick’s is celebrating their 13th annual Veteran’s Appreciation Event on Sunday, November 13th. Veterans will be able to choose a complimentary lunch or dinner entrée. Veterans must provide proof of military service. Be sure to contact your local McCormick & Schmick’s as this is valid at participating restaurants only. Also, Space is limited and reservations are highly recommended. For more information visit: M&S Veterans Appreciation Event.

McCormick & Schmick’s Seafood Restaurants – free lunch or dinner, Nov 11, 2013 (2013):McCormick & Schmick’s is celebrating their 13th annual Veteran’s Appreciation Event on Sunday, November 13th. Veterans will be able to choose a complimentary lunch or dinner entrée. Veterans must provide proof of military service. Be sure to contact your local McCormick & Schmick’s as this is valid at participating restaurants only. Also, Space is limited and reservations are highly recommended. For more information visit: M&S Veterans Appreciation Event.

·  Outback Steakhouse – A week of Free Bloomin’ Onions and Cokes Nov. 11(2013). Outback Steakhouse is honoring America’s military veterans by offering active duty military and veterans a free Bloomin’ Onion and a Coca-Cola product during the week leading up to Veteran’s Day. This offer is available to Military Personnel who have one of the following forms of identifications: U.S Uniform Services Identification Card, U.S Uniform Services Retired Identification Card, Current Leave and Earnings Statement (LES), DD form 214 Veterans Organization Card (i.e., American Legion and VFW), Photograph in Uniform, Wearing Uniform. For more information, visit, http://outback.com/companyinfo/veteransday.aspx.

Outback Steakhouse – A week of Free Bloomin’ Onions and Cokes Nov. 11(2013). Outback Steakhouse is honoring America’s military veterans by offering active duty military and veterans a free Bloomin’ Onion and a Coca-Cola product during the week leading up to Veteran’s Day. This offer is available to Military Personnel who have one of the following forms of identifications: U.S Uniform Services Identification Card, U.S Uniform Services Retired Identification Card, Current Leave and Earnings Statement (LES), DD form 214 Veterans Organization Card (i.e., American Legion and VFW), Photograph in Uniform, Wearing Uniform. For more information, visit, http://outback.com/companyinfo/veteransday.aspx.

· The Outback understands commitment. For the past two years, The Outback, with the help of their patrons, has donated $2 Million to Operation Homefront, a non-profit organization providing everyday and emergency support for active troops, wounded warriors and their families.

·  Sizzler Restaurants, Nov. 11, 2013 (2013). Buy one get one free, 6 oz. Steak Entree with the purchase of a second one. Valid with proof of military service. More info.

Sizzler Restaurants, Nov. 11, 2013 (2013). Buy one get one free, 6 oz. Steak Entree with the purchase of a second one. Valid with proof of military service. More info.

·  Spaghetti Warehouse Once in a Lifetime Veteran’s Day Celebration (2013). In honor of US military veterans and the unique once in a lifetime date: 11-11-11, Spaghetti Warehouse is offering lasagne or any original recipe spaghetti entree for only $0.11, with the purchase of a lasagne or any original recipe spaghetti entree at regular price. This offer is open to everyone, not just veterans. Download the coupon at their website.

Spaghetti Warehouse Once in a Lifetime Veteran’s Day Celebration (2013). In honor of US military veterans and the unique once in a lifetime date: 11-11-11, Spaghetti Warehouse is offering lasagne or any original recipe spaghetti entree for only $0.11, with the purchase of a lasagne or any original recipe spaghetti entree at regular price. This offer is open to everyone, not just veterans. Download the coupon at their website.

·  Subway – Free Six Inch Sub, November 11, 2013(2013). Select SUBWAY® Restaurants will offer a FREE six inch sub or flatbread to military veterans on Veteran’s Day. This offer is valid only on November 11, 2013 at participating local SUBWAY® restaurants, Military ID or proof of service required. Note: SUBWAY® Restaurants are franchises, so this offer may not be available everywhere. Please call ahead for participation and times.

Subway – Free Six Inch Sub, November 11, 2013(2013). Select SUBWAY® Restaurants will offer a FREE six inch sub or flatbread to military veterans on Veteran’s Day. This offer is valid only on November 11, 2013 at participating local SUBWAY® restaurants, Military ID or proof of service required. Note: SUBWAY® Restaurants are franchises, so this offer may not be available everywhere. Please call ahead for participation and times.

·  Texas Roadhouse – free lunch, Nov. 11 (11:00 a.m. – 2:00 p.m.) (2013). Every Texas Roadhouse location across the country will participate in the free lunch event to honor the men and women of our armed forces. Offer good for All veterans – including all active, retired or former U.S. military. ID Required. See the Texas Roadhouse Veterans Day page for more information.

Texas Roadhouse – free lunch, Nov. 11 (11:00 a.m. – 2:00 p.m.) (2013). Every Texas Roadhouse location across the country will participate in the free lunch event to honor the men and women of our armed forces. Offer good for All veterans – including all active, retired or former U.S. military. ID Required. See the Texas Roadhouse Veterans Day page for more information.

·  T.G.I. Friday’s – Buy one get one free Nov 11 (2013).Valid for all US Military personnel and veterans. Must wear uniform (if permitted by your service) or present military ID or other proof of service. Only valid at participating locations for anyone with an old or current military ID. More details on TGIFridays.com.

T.G.I. Friday’s – Buy one get one free Nov 11 (2013).Valid for all US Military personnel and veterans. Must wear uniform (if permitted by your service) or present military ID or other proof of service. Only valid at participating locations for anyone with an old or current military ID. More details on TGIFridays.com.

·  The Olive Garden, Free entrée (2013). Offer good for veterans and active duty military, November 11th during regular business hours. Chose from a special menu; all entrées include freshly baked garlic sticks and choice of soup or salad. Offer good in US and Canada, proof of service required. More info.

The Olive Garden, Free entrée (2013). Offer good for veterans and active duty military, November 11th during regular business hours. Chose from a special menu; all entrées include freshly baked garlic sticks and choice of soup or salad. Offer good in US and Canada, proof of service required. More info.

·  Twin Peaks, Nov. 11 (2013). Free entrée for service men and women (up to $10). Good for veterans and active service personnel with valid ID or proof of service. Dine in only; gratuity not included. Find a location near you.

Twin Peaks, Nov. 11 (2013). Free entrée for service men and women (up to $10). Good for veterans and active service personnel with valid ID or proof of service. Dine in only; gratuity not included. Find a location near you.

·  Uno Chicago Grill, Nov. 11 (2013). Veteran’s Day Discount: 19.43% discount on their food and non-alcoholic beverage beverages purchases from11/7 through 11/11. Why 19.43%, do you ask? That is the year UNO invented deep dish pizza. Offer good for all military for veterans and active duty military. ID or proof of service required: Show up in uniform (if your service permits), provide military ID, show a picture of yourself in uniform, or have other ID showing proof of service

Uno Chicago Grill, Nov. 11 (2013). Veteran’s Day Discount: 19.43% discount on their food and non-alcoholic beverage beverages purchases from11/7 through 11/11. Why 19.43%, do you ask? That is the year UNO invented deep dish pizza. Offer good for all military for veterans and active duty military. ID or proof of service required: Show up in uniform (if your service permits), provide military ID, show a picture of yourself in uniform, or have other ID showing proof of service

Home Depot and Lowe’s Military Coupon Updates

Update: Home Depot and Lowes 10% Military Discount Available Everyday.

Home Depot Military Discount: The Home Depot(R) is offering all active duty personnel, reservists, retired military, veterans and their families a 10 percent discount off their purchases in honor of Veteran’s Day. The offer is valid on purchases of up to $2,000 for a maximum of $200 and is available at The Home Depot stores, The Home Depot Design Center locations, Yardbirds and EXPO Design Center(R) locations. The 10% military discount is available everyday for active duty and retirees, but not all veterans. Home Depot makes this offer available to all veterans on most military holidays. You can alsofind Home Depot discounts online.

Home Depot Military Discount: The Home Depot(R) is offering all active duty personnel, reservists, retired military, veterans and their families a 10 percent discount off their purchases in honor of Veteran’s Day. The offer is valid on purchases of up to $2,000 for a maximum of $200 and is available at The Home Depot stores, The Home Depot Design Center locations, Yardbirds and EXPO Design Center(R) locations. The 10% military discount is available everyday for active duty and retirees, but not all veterans. Home Depot makes this offer available to all veterans on most military holidays. You can alsofind Home Depot discounts online.

Lowe’s Military Discount: Lowe’s Companies, Inc. will offer all active, reserve, honorably discharged, retired military personnel and their immediate family members a 10 percent discount on in-store U.S. purchases made during the Veterans Day holiday. The discount is available Nov. 11. The discount is available on in-stock and special order purchases up to $5,000. To qualify, individuals must present a valid military ID or other proof of service. Excluded from the discount are sales via Lowes.com, previous sales, and purchases of services or gift cards. Like Home Depot, Lowes offers this discount daily to active duty military members, but not to veterans. However, they extend the offer to military veterans on military holidays. You can also find exclusive discounts at Lowe’s.com.

Lowe’s Military Discount: Lowe’s Companies, Inc. will offer all active, reserve, honorably discharged, retired military personnel and their immediate family members a 10 percent discount on in-store U.S. purchases made during the Veterans Day holiday. The discount is available Nov. 11. The discount is available on in-stock and special order purchases up to $5,000. To qualify, individuals must present a valid military ID or other proof of service. Excluded from the discount are sales via Lowes.com, previous sales, and purchases of services or gift cards. Like Home Depot, Lowes offers this discount daily to active duty military members, but not to veterans. However, they extend the offer to military veterans on military holidays. You can also find exclusive discounts at Lowe’s.com.

Free Park Admissions for Veterans Day

Anheuser-Busch Parks. Anheuser-Busch Parks offers Active Duty Service Members free admission for them and up to 3 dependents to any of their parks once a year. Throughout 2013, members of the military and as many as three direct dependents may enter SeaWorld, Busch Gardens or Sesame Place parks with a single-day complimentary admission. The Here’s to the Heroes program is only available to Any active duty, activated or drilling reservist, or National Guardsman. Eligible parks include: Adventure Island, Busch Gardens (Tampa Bay or Williamsburg), SeaWorld (Orlando, San Diego, or San Antonio), Sesame Place, and Water Country USA. Not valid at Discovery Cove and Aquatica. Christmas Town at Busch Gardens in Williamsburg, Va. is not included as part of this program. For more information and to register, visit: Free admission summary, and ticket application.

Anheuser-Busch Parks. Anheuser-Busch Parks offers Active Duty Service Members free admission for them and up to 3 dependents to any of their parks once a year. Throughout 2013, members of the military and as many as three direct dependents may enter SeaWorld, Busch Gardens or Sesame Place parks with a single-day complimentary admission. The Here’s to the Heroes program is only available to Any active duty, activated or drilling reservist, or National Guardsman. Eligible parks include: Adventure Island, Busch Gardens (Tampa Bay or Williamsburg), SeaWorld (Orlando, San Diego, or San Antonio), Sesame Place, and Water Country USA. Not valid at Discovery Cove and Aquatica. Christmas Town at Busch Gardens in Williamsburg, Va. is not included as part of this program. For more information and to register, visit: Free admission summary, and ticket application.

Colonial Williamsburg Free Admission. Colonial Williamsburg offers free weekend-long admission tickets to active-duty military, reservists, retirees, veterans, and their immediate dependents from Nov. 11 . The complimentary ticket includes admission to Colonial Williamsburg exhibition sites, art museums, and most daytime programs, as well as free parking and use of the shuttle bus system. Tickets are only available at on-site ticket sales locations. Tickets are also available to families of deployed service members. Tickets available on the following dates: Nov. 11-13.

Colonial Williamsburg Free Admission. Colonial Williamsburg offers free weekend-long admission tickets to active-duty military, reservists, retirees, veterans, and their immediate dependents from Nov. 11 . The complimentary ticket includes admission to Colonial Williamsburg exhibition sites, art museums, and most daytime programs, as well as free parking and use of the shuttle bus system. Tickets are only available at on-site ticket sales locations. Tickets are also available to families of deployed service members. Tickets available on the following dates: Nov. 11-13.

Fee Free Day at National Parks. To honor America’s service men and women, Secretary of the Interior Ken Salazar announced that areas managed by the National Park Service would not charge entrance fees for Veteran’s Day weekend – November 11, 2013. Over 100 national Parks will be participating in this event.

Fee Free Day at National Parks. To honor America’s service men and women, Secretary of the Interior Ken Salazar announced that areas managed by the National Park Service would not charge entrance fees for Veteran’s Day weekend – November 11, 2013. Over 100 national Parks will be participating in this event.

Historic Jamestowne – Free Admission. The National Park Service commemorates Veterans Day with Fee Free days at Historic Jamestowne November 11-13. Free admission for everyone. See events calendar.

Knotts Berry Farm Military Tribute Days – Free Admission. Knott’s Berry Farm has an annual Military Tribute event in which they offer military members past and present by offering free park admission. This year the Military Tribute Days run from November 1 – 24 November (Thanksgiving Day). Veterans or current serving military personnel plus one guest get in FREE with proper ID presented at Knott’s turnstile (DD214, Veterans Administration Hospital ID or Active Military Service ID). Purchase up to six additional tickets for just $17 each. More info.

Knotts Berry Farm Military Tribute Days – Free Admission. Knott’s Berry Farm has an annual Military Tribute event in which they offer military members past and present by offering free park admission. This year the Military Tribute Days run from November 1 – 24 November (Thanksgiving Day). Veterans or current serving military personnel plus one guest get in FREE with proper ID presented at Knott’s turnstile (DD214, Veterans Administration Hospital ID or Active Military Service ID). Purchase up to six additional tickets for just $17 each. More info.

Pro Football Hall of Fame – Free Admission. Annual Veterans Day Salute, November 07, 2013, 09:00 AM – 05:00 PM. Any veteran or member of the armed forces and their spouse or a guest will be admitted free of charge to the Hall of Fame for a day-long recognition of US Military veterans. Members of the Blue and Gold Star Mothers will also be eligible for free admission. There will be a special ceremony beginning at 10:00 a.m. in the Hall of Fame’s NFL Films Theater. More information.

Pro Football Hall of Fame – Free Admission. Annual Veterans Day Salute, November 07, 2013, 09:00 AM – 05:00 PM. Any veteran or member of the armed forces and their spouse or a guest will be admitted free of charge to the Hall of Fame for a day-long recognition of US Military veterans. Members of the Blue and Gold Star Mothers will also be eligible for free admission. There will be a special ceremony beginning at 10:00 a.m. in the Hall of Fame’s NFL Films Theater. More information.

San Jacinto Monument and Museum (La Porte, TX). November 7-13: Free admission to the theatre, Observation Floor, and the special exhibit to all veterans and their families. More info.

Veteran’s Day Discounts – Retail Stores & More

Here are some additional Veteran’s Day Discounts. In all cases, be sure to provide proper ID or proof of service. In addition, some of these stores are franchises, so verify participation before assuming the discount is in place.

·  Amazon.com – Free MP3 album download“Veterans Day Honor” This free downloadable album includes 12 songs as performed by the military bands and ensembles of the U.S. Armed Forces. Visit Amazon now through Veteran’s Day to download the album for free(album will be full price again starting Nov. 11).

Amazon.com – Free MP3 album download“Veterans Day Honor” This free downloadable album includes 12 songs as performed by the military bands and ensembles of the U.S. Armed Forces. Visit Amazon now through Veteran’s Day to download the album for free(album will be full price again starting Nov. 11).

· Big Lots – 10% off your entire purchase with valid military ID. more info.

· Cabela’s. Cabela’s is giving their standard employee discount to all US military veterans, active duty military, Guard/Reserves, law enforcement, fire and EMS personnel on Nov. 10-11. Discount varies from 5% to 20%, depending on the item.

· Dollar General. 10% discount on entire purchase on Veteran’s Day. Offer good for all active-duty military, retirees, veterans, Guard/Reserve, & immediate family members. The coupon can be found in the store circular, or by asking an employe. Also good online from Nov 11-13, use Coupon Code VETERANSDAY. More info.

· Free Business Cards and Checks. Get 25 FREE Checks – Choose from 6 different designs or upgrade to premium checks and choose from many more designs. Bonus Offer – Get 250 Free Business Cards! FREE Checks & Business Cards offer.

· Free Car wash. Thousands of car washes around the country are offering vets a free car wash on Veterans Day. Find a list at Grace for Veterans, which helped veterans receive 101,537 FREE Washes on Veterans Day in 2010.

·  Jos. A. Bank Specials: Veterans Day Sale- 1 Day Only! All Suits On Sale- 2nd for $47 Mix ‘n Match. 40% Off All Dress Shirts, Sport shirts, Ties & Sportswear. Free Shipping on Orders $195+. Valid: November 11. JoS. A. Bank Veterans Day Sale Orders.

Jos. A. Bank Specials: Veterans Day Sale- 1 Day Only! All Suits On Sale- 2nd for $47 Mix ‘n Match. 40% Off All Dress Shirts, Sport shirts, Ties & Sportswear. Free Shipping on Orders $195+. Valid: November 11. JoS. A. Bank Veterans Day Sale Orders.

·  K-Mart. Exclusive Early Veterans Day Sale – Nov. 10th! EXTRA 5-10% off Almost Everything with coupon code VETERANSDAY. Friday & Saturday Specials + EXTRA 5-15% off & FREE Shipping orders of $49 with coupon code HOLIDAY.

K-Mart. Exclusive Early Veterans Day Sale – Nov. 10th! EXTRA 5-10% off Almost Everything with coupon code VETERANSDAY. Friday & Saturday Specials + EXTRA 5-15% off & FREE Shipping orders of $49 with coupon code HOLIDAY.

· Netflix: Netflix – One Month Free Trial.

· Seven-Eleven – Free small Slurpee on Nov. 11 from 11 a.m. and 7 p.m. Offer good to all current and former military members. ID or proof of service required.

· Sports Authority – 15% off all purchases. All Veterans and Military personnel please stop by your local Sports Authority store to receive 15% OFF YOUR ENTIER PUCHSASE on 11.11.11 ONLY! Please show proper identification or proof of service at check-out to receive this special offer.

· Sport Clips – Veterans Day National cut-a-thon and Help A Heroprogram. Sport Clips is the official haircutter of the VFW and will donate $1 from every haircut during the National Cut-a-Thon to VFW’s Operation Uplink, which provides free phone time to active-duty military personnel and hospitalized veterans. Sports Clips stores also offer a offer a Heroes discount which includes active and retired military. Find a location near you.

· Steve Madden. We’d like to salute our heroes by doubling our everyday military discount of 15% to 30% OFF for Veteran’s Day ONLY. Valid with a form of Military identification (past or present) in Steve Madden stores only (not valid online). *Full priced merchandise only. Find a store near you.

· Tim Hortons – all US locations are offering a free donut to all veterans (check out the Star Spangled donut!).

Free Hugo® Canes for Veterans.

Sam’s Club® locations nationwide will distribute 36,000 Hugo® canes free of charge on November 9th, 10th, 11th, 2013 to U.S. military veterans in need of mobility assistance. Limited quantities available, while supplies last. Sam’s Club® Membership is not required, but proof of military service may be required. For more information, visit HugoSalutes.com.

Sam’s Club® locations nationwide will distribute 36,000 Hugo® canes free of charge on November 9th, 10th, 11th, 2013 to U.S. military veterans in need of mobility assistance. Limited quantities available, while supplies last. Sam’s Club® Membership is not required, but proof of military service may be required. For more information, visit HugoSalutes.com.

Applebee’s — All veterans and active-duty military eat free from a limited menu on Veterans Day.

Chilis — Veterans and service members can dine for free from a special six-item menu on Veterans Day.

Golden Corral — Military Appreciation Monday includes a free dinner, Nov. 11, from 5 p.m. to 9 p.m. for military retirees, veterans, and current service members.

Famous Dave's — Offers for free or discounted meals on Veterans Day vary by location.

Hooters — All veterans and service members get 10 free wings with the purchase of a drink.

Krispy Kreme — A free donut is available for all service members, retirees and veterans.

McCormick & Schmick's Seafood Restaurants — participating McCormick & Schmick's Seafood Restaurants are offering a complimentary entree to vets from a special menu on a space-available basis. Online reservations are highly recommended.

Outback Steakhouse — Outback will offer veterans and military a free Bloomin' Onion and beverage

Subway Restaurants — Free six-inch sub or flatbread available to military vets on Veterans Day.

Texas Roadhouse — Free meals available to veterans from opening until 4 p.m. on Veterans Day.

T.G.I. Friday's — Veterans and service members can buy one meal and get another free.

UNO Chicago Grill — UNO is offering a 19.43 percent discount on food and non-alcoholic beverage beverages to vets and military. The chain explains that 1943 was the year UNO invented the deep dish pizza.

Abuelo's Mexican Food — Offers vary by region.

Buca di Beppo Italian Restaurants — Special offers for vets on Veterans Day.

RETAIL DEALS

Amazon.com — A free downloadable MP3 album includes 12 songs performed by military bands and ensembles from now through Veterans Day.

The Dollar General — Veterans, service members and their immediate families can receive a 10-percent discount with a Veterans Day coupon.

Home Depot — Offers a 10 percent discount to all veterans on Veterans Day. Home Depot offers a 10 percent discount year-round to active duty military and retirees.

Lowe's — All veterans receive the 10 percent discount for purchases of up to $5,000. A 10 percent discount is available year-round to active-duty military and retirees.

Sam's Club — Sam's Club will give away collapsible Hugo Canes on Veterans Day to military veterans who need them.

Seven-Eleven — On Nov. 11 from 11 a.m. to 7 p.m., veterans can get a free small Slurpee.

Cabela's Outdoor Store — Employee discounts are being offered to all veterans, active-duty military and reserve-component troops, along with law-enforcement, fire and emergency-management personnel. Discounts vary from 5 percent to 50 percent, depending on item.

Build-a-Bear Workshop — Members of the armed services, including the Coast Guard and ROTC, receive a 20 percent discount on any one transaction at the workshop.

Fashion Bug — Offering 20 percent off all plus-size and misses clothing purchases with a copy of military ID or spouse's military ID.

Sports Clips Haircuts — Offering free haircuts to active-military and veterans.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

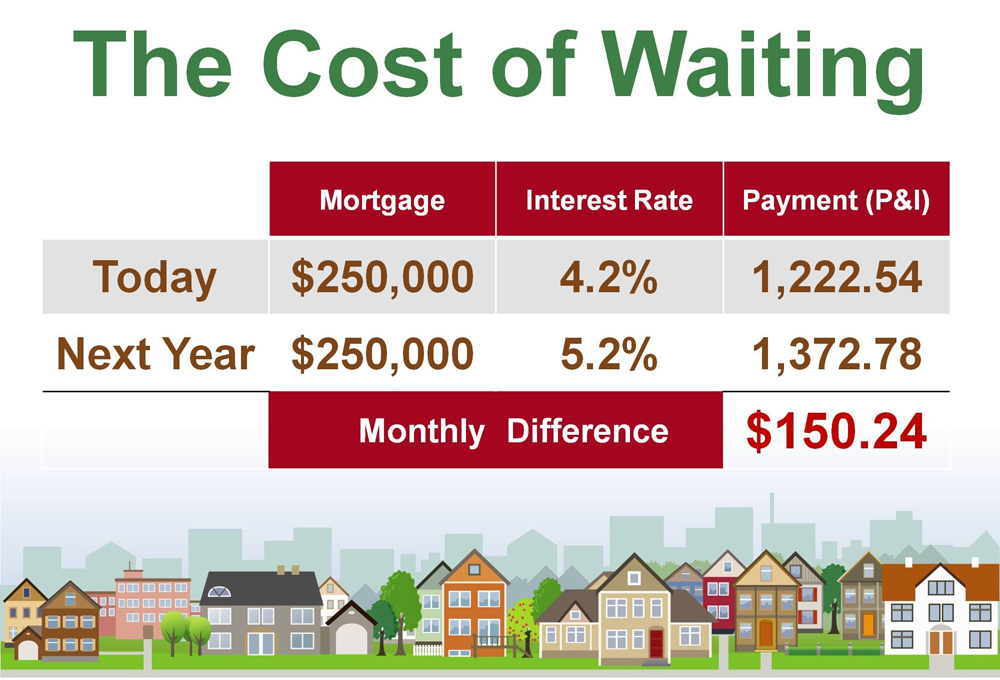

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

By: Ashley Harris

By: Ashley Harris Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world.

Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world. by

by

Being overpriced is a bad start

Being overpriced is a bad start